Thursday, August 31, 2006

How to be Your Own Bank

For those of you saving along, you’ve probably come into some challenges with trying to save $1 per day. The biggest problem of course is having only 5 or 10-dollar bills on hand to put into your fund, but no singles.

By now, on day 8 you should have $8 in each pile of money (savings, investing, and giveaway). If you only have a 5-dollar bill on hand to put into your fund, you can now make change for yourself. You are in effect being your own bank!

Let’s look at how this can idea can grow as we continue to regularly add money to our savings.

On the 20th day you’ll have $20 in each pile. Then you can break $20 bills. For those of you actually in the club you’ll know this is a big deal.

Perhaps further down the road, you may need to take a small loan from a bank. If your savings were large enough you could borrow the money from yourself and pay yourself the interest. The interest would go back to you and not to the bank.

Maybe a co-worker needs to use a payday advance service because they’re low on money. Could you not loan them the money and collect a small fee for providing the service? You certainly could.

We’ll talk more about this, but I wanted to get you thinking of the world of opportunities that begin to open up because you’re starting to save money.

Being your own bank to change a 5-dollar bill into singles may not seem like a big deal today, but it’s a window into the opportunities that will follow.

Keep saving. Keep putting $1 per day into your 3 funds and your life will change in amazing ways.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Wednesday, August 30, 2006

Million Dollar Savings Club Update: Day 7

Day 7:

How have your saving efforts been coming? Have you been able to save one dollar per day in each pile (Savings, Investing, Give-Away)?

By now you should have $7 in each pile for a total of $21. Today, I will share with you some of my challenges and rewards:

Building the habit is difficult. I won’t kid you. Keeping the money in a place where you can see it, perhaps next to your bed is key. Without having the money in plain view I would have surely forgotten to add to it daily.

Another challenge is keeping cash on hand-- single dollar bills to be exact. I regularly have to keep a pipeline of singles in my wallet and not spend them.

So that’s the hard part. Here are some rewards:

It’s amazing to see how quickly these piles of money build up. Again, seeing the money is key. Let’s be honest $21 is nothing special. But seeing it build up is powerful. It seems like yesterday this club started and already there is a pile of money on the side of my bed.

Here’s something else: Because I’m setting money aside everyday, I find myself thinking more about saving money. Again, seeing the money makes me think more about saving.

Also, I’m much more conscious about spending money. For example, do I really want to pull $20 out of an ATM machine and pay a $3 fee? After all, that’s a days worth of savings!

Hopefully you’re experiencing the same challenges and rewards. If you forgot to add to your pile for a day, don’t quit. Just do the best you can.

Remember it’s a marathon. Not a sprint race!

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Tuesday, August 29, 2006

August 29th Blog Carnival

Enjoy...

Brian Kim presents The Myth of Thinking Big posted at Brian Kim.net - Invest in Yourself and Make It Happen.

Katie presents Financial bloggers losing focus posted at Aridni, saying, "Thanks for hosting--"

Milo Riano presents You Ought to Know that Career is a Marathon not a Sprint Race posted at Milo Riano, saying, "You have been working the whole year like there’s no tomorrow. You sacrificed a lot of things including your loved ones for the sake of work explaining to them that it is for their future. You were a very good soldier diligently following your manager and putting up through all his shortcomings and mistakes."

Brandon Peele presents New Life Course I posted at GT.

Brandon Peele presents Gestalt Therapy posted at GT.

Peter Kua presents Only 10 reasons needed for venture capitalists to fund your idea posted at RadicalHop.com.

David Trager presents The Key To Freedom posted at Dave Trager.com.

Steve Faber presents The Three Strategies to Maximize Your Financial Success posted at DebtBlog.

Peter Kua presents 21 plain sailing habits toward creativity posted at RadicalHop.com.

Beverly Keaton Smith presents Jumpstart Your Life Through Affirmations posted at Embrace Your Gifts and Soar!.

David Maister presents Integrity Impugned posted at Passion, People and Principles.

Matt Inglot presents Go Ahead and Check Your E-mail First Thing in the Morning posted at Matt Inglot.

Jeannie Bauer presents 7 Tip Offs that Politics Run Rampant in Your Company posted at Bouncing Back.

Alexander Becker presents Subjective Reality: How Desire Always Overrides Methods posted at WOW, saying, "Get rid of limiting beliefs and start receiving directly."

Simran Gill presents Personal Finance and Simulation Modelling posted at Simran Gill –> Article and URL Archive, saying, "Article on personal finance and modelling - hope it works"

J Clegg presents 10 Ways to Change Your Life This Weekend posted at A Life Journey.

Conn Stell presents Genuine Desires – how to use them to Succeed posted at Personal Growth - achieve excellence in your life.

If you have an article you'd like to see posted on next week's carnival, post it using my carnival submission form.

Technorati tags:

personal growth carnival, blog carnival.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Thursday, August 24, 2006

Day Two of the Million-Dollar Savings Club

I thought I’d write this post saying how easy it is save $1 per day in 3 separate piles. But that’s already not proving to be the case. Here we are at day two and I already ran into a problem.

Last night, before I went to bed I saw (on my night-stand) my 3 piles of money: Savings, Investing, and Giveaway. I thought to myself “Oh yeah, I have to put another $1 in each pile”. Can you imagine my surprise when I looked in my wallet to find only 2 $1 bills? That’s right. I somehow spent all of my singles in the last two days! I had a $5 bill so I put that in the investing pile.

I will use it as ‘collateral’ with myself when I get some more singles today.

Saving $3 per day seems so easy to do. But, if you don’t keep a steady supply of singles in your wallet, being in ‘the club’ gets really hard.

TIP: Remember to keep a lot of singles on hand. By putting $3 daily into your savings fund, they’ll disappear quickly.

As of today I have:

Savings $2

Investing $6 ($4 will be returned tonight)

Give-Away: $2

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Wednesday, August 23, 2006

The Million Dollar Savings Club Kick Off!

Welcome to the beginning of the Million Dollar Savings club. I’ve been talking about this club for a while and today is the kick off. Now, you might be asking, what is it? Let me explain.

Savings in today’s age is at an all time low. People complain they don’t have enough money. Most people redline their finances, spending everything they have as soon as they get it. Then when something unexpected happens they turn to credit to ‘fix’ the problem. They incur more debt. Saving money becomes harder.

That’s why I created the Million Dollar Savings club. It’s an easy way we can all learn to save money together. Once you learn the habit of saving money your money problems will slowly disappear. When an emergency happens you’ll have money to fix the problem. You won’t turn to using credit cards. You’ll be able (maybe for the first time) to start investing money. You’ll grow richer each year. Ask yourself; do you have more money in the bank than you did a year ago? If not, you need to be in the club.

How the club works:

Well there are certainly no fees. It’s all based on the honor system. Here’s how to play:

At the beginning of each day place $1 in each of 3 piles:

- Savings

- Investing

- Give-Away

So to be in the club you must commit to $3 a day. I chose that amount because anyone can do this. Remember, you’re trying to build a habit. This new habit will feed on itself. You’ll have much more than $365 in each pile at this time next year. Just wait and see.

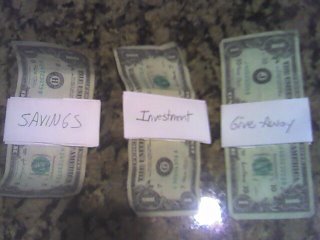

The picture above shows my 3 piles. Each pile today has $1 in it for a total of $3. Each pile is labeled, Savings, Investing, and Give-Away. I keep them right next to my bed so I can remember to add to them every day.

So welcome to your first day in being in the club. I put my $3 in, how about you?

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Tuesday, August 22, 2006

Carnival Of Personal Growth August 22nd

I would like to tell you about the Million Dollar Savings Club that I'll be kicking off tomorrow. It's my latest endevor to get us all to start saving some money. If you want to join the club there is no fee, it only requires that you follow along with the rest of us. Check back tomorrow (August 23rd) as we kick this off! It will be loads of fun and probably life changing for many of us.

A Quick Note About Blog Carnivals:

If you have a blog you should write an article and submit it my carnival. You will gain a link back to your site. It will give you new readers and help you get better search engine placement. It's simply one of the best ways to grow your blog. The only thing I ask is that you write an article about Personal Development. Don't Spam the carnival!

Everyone who submits an article should link to this page. It will raise the search engine positioning of the page and drive more traffic to everyone's site. This is why Blog Carnivals are wonderful for everyone envolved!

Enjoy this week's submissions:

Peter Kua is back again this week with Becoming a consultant in 5 easy steps. We have a new writer by the name of Joseph presenting his blog self help and personal development. Welcome to carnival Joe!

Jerry Lopper is a long time writer to this carnival. This week he is talking about Acceptance and the Easy Life. David Maister is also back again this week with Life Could Be Better. Dave always has good articles and this one is no exception.

Jack Yoest has a very interesting article called Three Duties of a Mentor. Jack offers this tip: "A mentor, like a good Board of Directors, offers the CEO (that would be you, the mentee) three talents: Contacts, Consulting, Capital"

Pamela Stewart has an excellent blog. In fact she's in my list of RSS Feeds. I keep on it regularly. I'm very proud to see her article in the carnival this week entitled: A special boost for wannabe entrepreneurs: My Declaration of Independence . A special note from Pam: "I thought this post might resonate with your readers. It does refer to a "movie" I put together to help inspire and unstick people who feel trapped in corporate jobs. So far more than 13,000 people have viewed it ... I hope you enjoy it! All the best,-Pam"

J Clegg is new to the carnival. Stop by and check out his article: 7 Ways to Overcome a Personal Development Slump. Thanks for the submission Jason..

Paul Newbury has a good post you or a friend may want to read if they've lost their job. It's entitled: How to deal with losing your job. Paul is going to be hosting the U.K. version of the Million Dollar Savings club. His is called 'The Million Pound Savings Club'. It's obviously for everyone in the U.K.

RMic is new to the carnival this week with an article called: How to make your dreams come true ?. Rmic says, "This is my first participation. My Blog is brand new. I hope you'll like my post :)". Let's all support him and stop by his new blog.

Christine Kane Always submits great articles. This week's is: The One Thing We Almost Always Forget to Do(And Why To Start Doing It) - Christine Kane - Blog » Blog Archive

Violeta is also a new contributor. She has an article that's bound to get some attention. It's called: How I quit smoking. Voileta adds, "I consider getting rid of bad habits as personal growth, this is why I thought my submission would fit in here." Congratulations on breaking the habit Violeta!

Tyler McKinna has a very intersting article this week called: Motivation for SuccessAchievementSuccessful. I have not read it, but I'll certainly be stopping by.

Lyrois is new to the carnival this week with an article WOW: Learn to Trust Your Inner Voice. Lyrois adds, "Do not suppress your instincts even when they suggest taking a day off." Welcome to Carnival Lyrois!

David Lorenzo has been with us a long time. This week he's back with the Promise of the Present Day

Emmanuel is talking about passion. Do you have it? Find out at: Emmanuel Oluwatosin: What is your Passion?

That concludes this edition. Submit your blog article to the next edition of

personal growth carnival

using My carnival submission form.

Technorati tags:

personal growth carnival, blog carnival.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Monday, August 21, 2006

The Million Dollar Savings Club: How to Prepare

Wednesday we’ll be kicking off the Million Dollar Savings Club. That’s the first day we’ll begin actually saving money. Here are a couple of tips you should do to prepare (I’m doing these myself):

First, take $20 out of the bank so you have about one week’s worth of savings ready to go. Truthfully, most people don’t carry much cash around anymore. You don’t want to get in a pinch where you don’t have money to put into the savings fund each day.

Second, take the $20 bill and break it into singles. You might need to buy something small like a coke and get $18-$19 back in change. Ask to get the change in all singles. If your bank will give you $20 in singles that will work even better.

Finally, get 3 paper clips to hold the money. Then get 3 slips of paper and label each: Savings, Investing, Give-Away. This way you can track each pile of money.

You might also think about where you’re going to place your piles of money. Try to pick a place where you’ll see it everyday. That way you won’t forget to add money to it.

Wednesday will be the day we all start, so be ready!

For those of you in the U.K – Paul Newby over at http://improvingmylife.blogspot.com/ will be starting a U.K. based version called the Million Pound Savings Club.

The Rules for the Million Dollar Savings Club are here.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Thursday, August 17, 2006

The Million Dollar Savings Club: Begins August 23rd

I’d personally like you to join my “Million Dollar Savings Club”. What is the club? It’s a way for us to learn to save money together. Here are the rules:

- You will save $3 dollars per day in cash.

- Each dollar will be placed equally in three piles: One for saving, One for Investing, and One for giving away.

- There are no membership fees or anything like that. To be a member of the club simply set your $3 into each pile every day. We’re working on the honor system.

Certainly anyone can be a member of the club. Anyone can save $3 per day.

You might be thinking, “If I’m saving $3 per day, why is it called the Million Dollar Savings Club? ” That’s a good question and here’s the answer: The habits we learn from saving $3 per day will grow. Countless millionaires will be created from the club because some people will simply start to save more. Some people will wisely invest the investing pile. Some people will love the incredible feeling of giving money away and want to give more. The truth is, that first $3 will grow into an incredible fortune for you. It will be an amazing and exciting experience for everyone in the club.

So let’s get ready for August 23rd. That’s the kick off date. Have your $3 ready, and welcome to the club!

More Posts:

How To Prepare

Kick Off

Day Two

Day 7

Day 8: How to Be Your Own Bank

Day 14

Day 15: Why Cash Is King

Day 20: Building the Habit

Day 29: How to Get Through a Cash Pinch

Day 30: Who's Winning? (September Leader-Board)

Day 36: Counting Cold Hard Cash

Day 38: Joining the Club

Day 45: Piles of Money!

Day 51: Travis Wright Joins the Club

Day 52 - 114: I moved the blog

Special Note: I have moved this blog, you can read more entires for the Million Dollar Savings club HERE. Enjoy - Bryan.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Wednesday, August 16, 2006

AOL’s Best POP Up Ever!

Let’s face it. America Online is notorious for continuously billing people monthly service fees when they want to cancel their service. In fact, you nearly have to cancel your credit card to stop the billing process.

A few weeks ago AOL announced a massive round of layoffs. They also announced AOL would be free.

You can imagine my surprise when my wife fired up her trusty AOL Software and saw a pop-up ad asking her to convert her paying membership to a new one. Which program? The free one!

Hats off to AOL. I think they did it right here and truthfully I’m impressed. They could have easily hit my wife’s credit card for $10 a month for years. Instead they did the right thing and won her as a patron for long long time.

The Lesson: If you want to win customers. Do the right thing. Nickel and dimming them to death won’t grow your business. It will only build ill will. I suspect AOL will be much better off from the path they’ve chosen.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Tuesday, August 15, 2006

Carnival Of Personal Growth August 15th

We're back again this week with a lot of new writers. So, I'd like to welcome all of the new writers this week to the carnival. If you have an article that you feel we'd like, certainly take the time to submit it (below).

David Trager has a nice article about something very important-- Leadership. My Experience Of Good Leadership

David Maister hits this week on an important topic. One that will bring success to anyone who uses it. It's about mentors, entitled: Can We Copy Our Heroes?

Marcus Markou has a nice article on marketing: Talk The Talk. Marketing Without a Budget

Gleb Reys presents an good read on self-discovery: Discover Your True Self

Tyler McKinna is talking movtivation this week with Motivation for Success|Achievement|Successful

Edward Mills has an interesting article on Finding Money: Oh What Fun!. Something we all love to do from time to time.

Michael presents What Happens When You Mess up?. Here it is straight from Mike "This article talks about what to do when we do something wrong or make a mistake in our lives."

Emmanuel presents What do you carry inside?. In Emanuel's own words "A ballon with surely fly in the air as long as it contains air irrespective of its color or shape. It does not matter what color the balloon is nor does it matter the size or shape. What matters is the strength within it. A balloon with black color will even fly higher than one with white color if the black one contains more air that the white one."

Brian Kim is talking Focus this week with The Unstoppable Power of Focus

Jeannie Bauer has an article that I really liked. It's entitled Plant Seedlings for Tomorrow's Harvest of Success

Jen is new writer to our carnival. Let's all stop by her blog and say HI. Her article is : I'm Hearing Voices "I have a blog on parenting and recovery from alcoholism."

Joanne Hay has a good piece called The Wealth of the Heart.

Peter Kua is a long time writer to this carnival. This week he's back with A simple question stumping the physics grandmaster

Paul Newbury has a GREAT article on Intention Manifestation

And finally karen alonge brings us a sweet delivery

That concludes this edition. Submit your blog article to the next edition of

personal growth carnival

using my carnival submission form.

Technorati tags:

personal growth carnival, blog carnival.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Monday, August 14, 2006

Why You Must Learn How to Save Money

If you’re worrying about money it’s because you don’t feel you have enough. Every fortune begins with only a few dollars and grows from there. That’s why it’s so important to learn to save money. It’s a habit you must learn to develop.

You might feel like you can’t save money because you don’t have enough. This is because you’re a victim of today’s advertising. Advertisers have gotten very good at making you feel like you need things that you simply don’t need. We’re bombarded by advertisements from morning to night. It’s no wonder we’ve all bought a bunch of things we don’t really need.

Throw credit card companies into the mix and you’ve got a cocktail for financial hardships. Easy credit and fancy advertising can lead anyone into a pit of credit card debt that can be very hard to get out from. So how do you save money when you don’t have enough?

In that question is the answer. You see you really do have enough money. What you’re doing is paying your bills and spending the rest on things you think you need. People rarely have a money-making problem, they almost always have a money-spending problem. You must understand this. You already make enough money. You only have to play a better defense and learn to spend less. Why? Because until you discipline yourself to control your spending you’ll continue to have money problems—No matter how much money you make.

Learning to save money is actually pretty easy. You should set up an automatic system to save money before you get a chance to spend it. Trying to save it afterwards rarely works. The saying “Pay yourself First” is famous for a reason. Life seems to have a way of taking it before we can sock it away. If you’ve never saved money before do this:

Take 10 cents for every dollar you earn and get it out of our bank account immediately. It doesn’t matter how many bills or creditors you have screaming to be paid. Just get 10% out of your bank account. Pay yourself first. Pay yourself before anyone else gets paid. That’s how you save money. You’ll naturally adjust to the new spending level and everything will take care of itself.

So what do you do with the money if it’s not in your bank account? Well, for the first couple months I’d strongly suggest you keep the cold hard cash somewhere safe. Somewhere where you can see it regularly and here’s why:

Seeing a pile of money is so much more powerful than seeing a number on bank statement. A giant stack of 20’s or 100’s really drives home what you’re doing.

I started doing this a few years ago. I can vividly remember how quickly, I had a pile of money. By saving 10% of my $60,000 per year salary, I quickly had almost $500. Then a short while later it was $2,000. There’s something powerful about sitting on the couch counting out $2,000 in cold hard cash. No matter what financial problems I was having, I felt like I had a lot of money. Eventually that money made its way into a bank account and gets some interest now, but if you really want to save money you need to see the cash!

So let’s save 10 cents for every dollar we earn. Let’s pay ourselves first, and let’s do it in a way where we can see the cold hard cash.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Thursday, August 10, 2006

How to Instantly Spot a Lazy Person

Ask a diligent person to do something and you’ll find it will be done. Ask a lazy person to do the same thing and you’ll get something too. What will you get?

An Excuse!

That’s right. A lazy person will never tell you they are lazy. They’ll give you a reason why they couldn’t do it. You’ll find they do this with everything. Ask them why they don’t have a job? They’ll have an excuse ready for you. Ask them why they didn’t uphold their commitment to a dinner party? You’ll get yet another excuse.

We all run into unforeseen circumstances. Times when we can’t uphold our commitments. You can’t hold that against anyone. It’s in the excuse itself where you can find the lazy person. Are their excuses outlandish? Do they make sense? Would you use the same excuse? This is how you find the lazy person.

We need to understand that people who are always making excuses. People who never seem to get anything done are in fact people that will only slow you down. You will simply waste too much time and too much energy trying to get them to do anything. It’s much better to find someone else to simply do it. By working with diligent people. People, who won’t make an excuse, will save you a lot time and wasted effort.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Tuesday, August 08, 2006

Personal Growth Carnival for August 8th

Great articles keep comming in every week. If you have a blog of your own, I highly encourage you to post your best article in next week's carnival. It's a great way to get your work out there on the web.

Karen Alonge has a great article this week entitled knowing no-thing it's posted at postcards from nowhere.

David Maister is talking this week about how start your day. His article is entitled Start the Day Off Right! it's posted at David Maister's Passion, People and Principles.

Steve Faber has a nice piece on business, talking about The Business Adventure. It's posted at DebtBlog.

David Trager is writing about fear this week. A great topic indeed with his article entitled Fear- something to get rid of, or guidance to listen to? It's posted at Dreaming Of Reality—Adventures on the grid, saying, "a healthier way to look at the subject of fear."

Mike Myatt talks about personal branding. I believe you'll hear more about this in the comming years. His article The Power of Personal Branding is a must read. It's posted at N2 Growth Blog.

Peter Kuais back this week, this time with It is IMPOSSIBLE to Find Inner Peace posted at RadicalHop.com.

Matt Inglot asks a good question with Is It Wrong to be an Employee? posted at Matt Inglot.

Jerry Lopper has an interesting insight on connections: Connections Make Life Easier. I tend to believe they do!

Dave Cheong submitted an article entitled:5 Steps to Accomplishing your Goals. I'm going to be covering this topic soon. A good read. Thanks Dave.

Lyrois brings us 11 Ways to Improve Clarity and Start Getting Results with this advice: "Be clear about your goals and reap the rewards." Oh how true this is!

Jeannie Bauer has an interesting idea: Never Make Major Decisions at Night. Thanks, Jeannie, I'll try that one.

Milo Paulo milo G. Riano presents The Secret of Achieving Your Goals. I enjoyed this one too. Thanks for the submission.

Tim King is covering a very important topic. As you start making more money, you'll be fighting this more and more.... Overcoming Your Fear of Poverty posted at J. Timothy King’s Blog.

And finally....

Wondering which jobs pay the most? Kevin Kneupper answers this with What are the highest paying jobs in the U.S

This carnival is growing every week. It's truely exciting to see all the wonderful articles that are submitted. Submit your blog article to the next edition of

personal growth carnival

using my carnival submission form.

Technorati tags:

personal growth carnival, blog carnival.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Friday, August 04, 2006

How to Overcome Adversity? Look to the Caterpillar

Caterpillar’s are interesting creatures. They start their life as fuzzy seemingly insignificant bugs that transform themselves into beautiful butterflies. But how can a caterpillar teach you and I about life and adversity?

When you start anything new expect to struggle. In fact you should welcome it. Without struggle and adversity you’ll never become stronger. You simply won’t grow until you gain enough strength to get promoted to the next level of achievement. Many times we naturally want avoid the pain and disappointments struggle brings along. Struggle hurts. We want things easy and we want them now. So let’s look at our friend the caterpillar.

Consider the Caterpillar, a simple creature crawling around the earth perhaps with other bugs. One day the caterpillar gets a dream and decides to do something different. Climbing into a tree, it spends long hours building itself into a cocoon. Then the struggle begins.

Have you ever seen a caterpillar try to fight its way out of the cocoon? It’s a painful long struggle for this creature. Watching it, you and I might be tempted to help it and tear the cocoon. Thereby, making it easier for the caterpillar to get out. If we make this mistake we’d ruin the caterpillar. It would in fact never gain the needed strength to transform itself as a butterfly.

The caterpillar would never be able to fly. It would never be able to see the world through the eyes of the wonderful butterfly. No, that caterpillar would simply remain a caterpillar. It would never be promoted to a higher calling in life. It would spend the rest of its life crawling around the ground with the other bugs and eventually die.

That my friend is what we can learn from the caterpillar.

If we want to achieve great heights in life. If we want to enjoy prosperity and the abundance life can truly give us, we must learn to welcome the struggles life brings. It’s the only way we’ll gain the strength it takes to soar through this world at great heights.

Let’s welcome struggles as they come. Although they seem so incredibly painful we’ll always end up better because them.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Wednesday, August 02, 2006

How to Work Less and Get More Done

We live in an interesting time. Television and advertising dominate our lives. They lead us to believe things happen quickly. Watch an hour of television tonight. During that time you may see a crime committed and solved, or someone become a millionaire. In between these shows, you’ll see commercials.

Television advertising thrives on getting you to experience climatic moments. A couple is whisked away to a tropical beach. A newly married couple buys a new house. An overweight woman instantly has a thin muscular body.

The problem you and I run into is we expect life to work that way. We are impatient that we didn’t loose 10 pounds the first week we tried that diet. We expect our new business to be successful after only a few short months. We expect to fall in love within a few days.

These unrealistic expectations cause us to simply work too hard. You see, nothing in nature works that way because nature never acts in haste. If you want to know how you should be working, grow a garden. Why? You’ll see very small seemly insignificant changes everyday. Take a picture of that tomato plant. Look back a month later and you’ll see the growth. But you’ll never see it day to day. Everything in life works this way.

If you want to get more done you simply have to learn to work in rhythm with nature. Do you need more proof? Let’s turn our attention to rowing. A great sport indeed. Which team wins the race? Is it the strongest team, or the team that seemingly isn’t working at all? Isn’t it the team that effortlessly works in harmony with each stroke that wins the race? We must learn to act this way in everything we do.

You have to learn to pay attention to your environment and work in harmony with what’s around you. Even your computer has a natural speed. Learn to work in harmony with this machine and you’ll find yourself not feeling so worn out. This is not an easy skill to learn. It takes practice. You see, when you try to outpace nature you end up working too hard. Rarely do you get more done. You’ll only end up wearing yourself out. Let’s make it a point to pay more attention to nature and slow down a little. We’re all probably working just a little too hard.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us

Tuesday, August 01, 2006

Personal Growth Carnival August 1st 2006

Every week, I get more and more submissions for the personal growth carnival. I decided this week to list out the submissions and let you pick which ones to read. Personally they all look good.

This has been a record week for the carnival with a lot of new talent showing up. If you have a blog and want to be featured in the carnival it's a great way to let us all know about your site. Submitting an article is easy, just use this form. The only thing I ask is that you stay on topic and do not submit more than one article per week.

Keep 'em comming everyone. Great work!

So here you go, I proudly present the August 1st Carnival of Personal Growth:

Brandon Peele presents Spirituality is Integral to Humanity posted at GT.

David Maister presents You Gotta Serve Someone posted at David Maister's Passion, People and Principles.

Peter Kua presents Walk the talk: Experience of a first-time distributor posted at RadicalHop.com.

Kevin Kneupper presents What's the highest paying college major? posted at Free the Drones, saying, "A post on which college major students should select to make the most income vs. personal enjoyment."

Paul Newbury presents Motivation and Inspiration posted at Improving My Life.

Neville Ridley-Smith presents Oi You! Here's how to stay focussed! posted at Nev's Blog.

David Trager presents Dreaming Of Reality—Adventures on the grid posted at Dreaming Of Reality—Adventures on the grid, saying, "On the leading edge of thought.."

Keith presents How to Learn to Write and Achieve Greater Success posted at skillzdesign.com.

Christine Kane presents 21 Ways to Be More Creative posted at Christine Kane, saying, "Thanks!"

David Lorenzo presents Beyond the Call of Duty posted at The Career Intensity Blog.

Lyrois presents How to Motivate Yourself with One Word posted at WOW, saying, "Motivation through honor."

Tammy Lenski presents Stepping Up to Difficult Conversations: What My Grad Students Would Tell You posted at I Can't Say That!.

Steve Faber presents You're Already a Millionaire! posted at DebtBlog.

Brian Kim presents How to Find What You Love to Do posted at Brian Kim.

That's all for this week. Keep the posts comming, we all enjoy reading them and finding new blogs on the 'web.

Technorati tags:

personal growth carnival, blog carnival.

If you enjoyed this article Subscribe to my RSS Feed

Bookmark this page on del.icio.us

Bookmark this page on del.icio.us